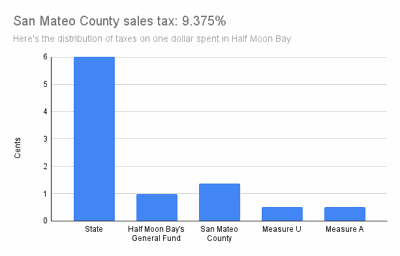

san francisco county sales tax rate

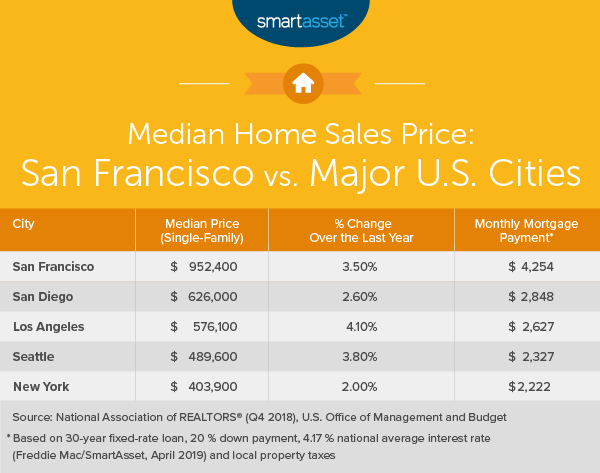

The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax. 6 rows The San Francisco County California sales tax is 850 consisting of 600 California state.

County Begins Collecting Higher Sales Tax Local News Stories Hmbreview Com

Please ensure the address.

. The Sales and Use tax is rising across California including in San Francisco County. In San Francisco the tax rate will rise from 85 to 8625. 5 digit Zip Code is required.

Depending on the zipcode the sales tax rate of san francisco may vary. This is the total of state county and city sales tax rates. A county-wide sales tax rate of 025.

94110 zip code sales tax and use tax rate San francisco San Francisco County California. The San Francisco County sales tax rate is 025. Some businesses are also required to file and pay the Gross Receipts Tax and other annual taxes.

Type an address above and click Search to find the sales and use tax rate for that location. Sales Tax and Use Tax Rate of Zip Code 94110 is located in San francisco City San Francisco. San Francisco County Sales Tax Rate.

The minimum combined 2022 sales tax rate for San Francisco California is. This is the total of state county and city sales tax rates. What is the sales tax rate in San Francisco California.

250 for each 500 or portion thereof. The South San Francisco California sales tax is 750 the same as the California state sales tax. Proposition F was approved by San.

To review the rules in California visit our state-by-state guide. Property Taxes in San Francisco Under State law Proposition 13 real property is reappraised only when a change-in-ownership occurs or upon completion of new construction. San Francisco CA Sales Tax Rate The current total local sales tax rate in San Francisco.

City Hall Office Hours. The minimum combined sales tax rate for San Francisco California is 85. Majestic Life Church Service Times.

The California sales tax rate is currently. More than 100 but less than or equal to 250000. Click on a tax below to learn more and to file a return.

5 rows The San Francisco County Sales Tax is 025. While many other states allow counties and other localities to collect a local option sales tax. Has impacted many state nexus laws and sales tax collection requirements.

Restaurants In Matthews Nc That Deliver. The San Francisco sales tax rate is. San Francisco City Hall is open to the public.

Did South Dakota v. San Francisco County Sales Tax Rate. Monday through Friday in room 140.

More than 250000 but less than 1000000. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax. Method to calculate San Francisco County sales tax in 2021.

The Office of the Treasurer Tax Collector is open from 8 am. San Francisco County in California has a tax rate of 85 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in San Francisco County totaling 1. 3 rows The current total local sales tax rate in San Francisco County CA is 8625.

SAN FRANCISCO COUNTY 8625 SAN JOAQUIN COUNTY 775 City of Lathrop 875 City of Lodi 825 City of Manteca 825 City of Stockton 900 City of Tracy 825 SAN LUIS. Opry Mills Breakfast Restaurants. Tax rate for entire value or consideration is.

The California sales tax rate is currently 6. Presidio of Monterey Monterey 9250. Louis Missouri 5454 percent close.

The 2018 United States Supreme Court decision in South Dakota v. The County sales tax rate is. As we all know there are different sales tax rates from state to city to your area and everything combined is the.

Presidio San Francisco 8625.

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

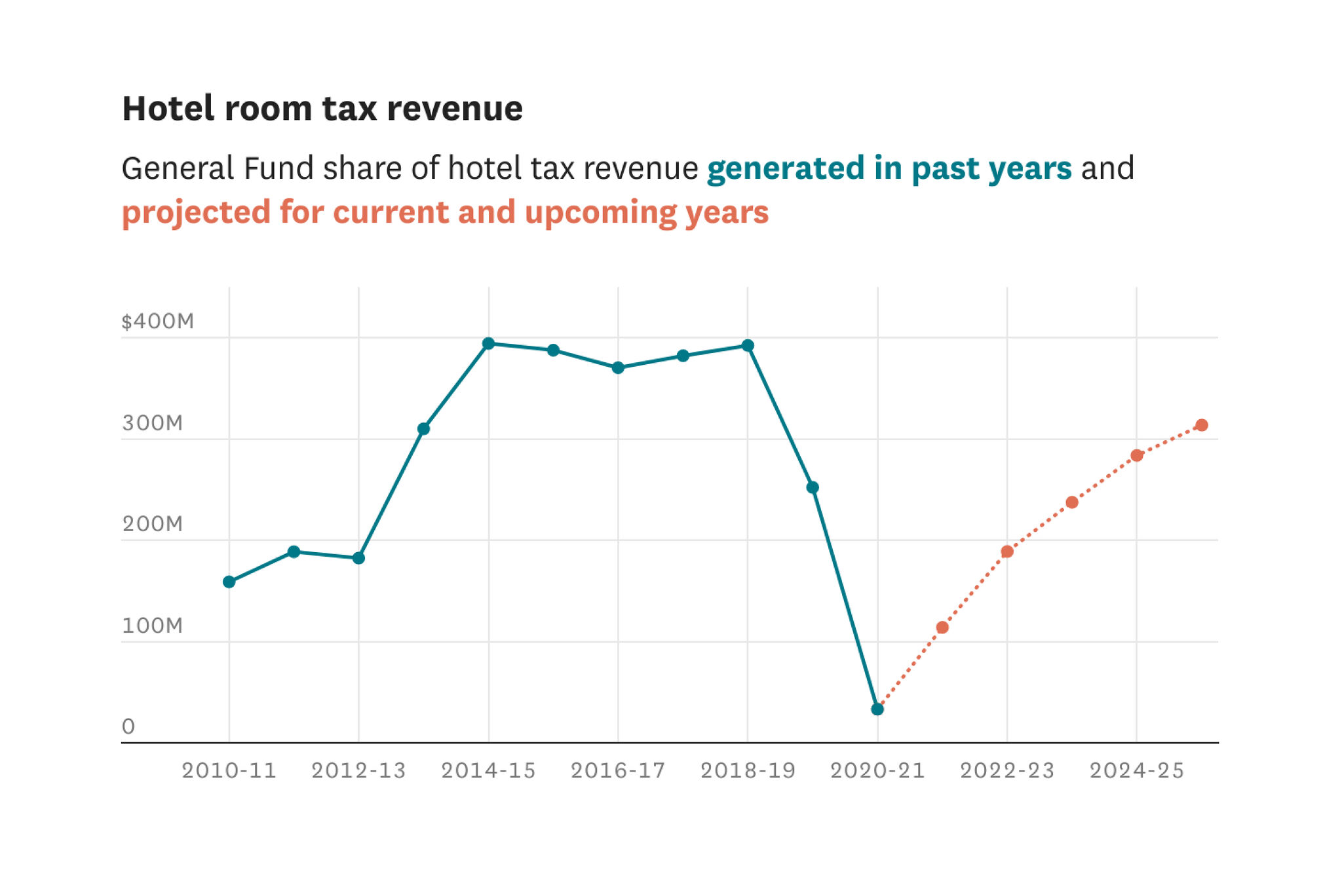

San Francisco Is Projected To Have 6 3 Billion To Spend In 2022 2023 Here S How The Pandemic Is Impacting Those Numbers

Sales Gas Taxes Increasing In The Bay Area And California

Sales Tax Collections City Performance Scorecards

How To Charge Your Customers The Correct Sales Tax Rates

California Taxpayers Association California Tax Facts

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

States With Highest And Lowest Sales Tax Rates

Understanding California S Sales Tax

Understanding California S Sales Tax

Property Taxes By State Embrace Higher Property Taxes

California City County Sales Use Tax Rates

Understanding California S Sales Tax

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Understanding California S Sales Tax

San Francisco Prop W Transfer Tax Spur